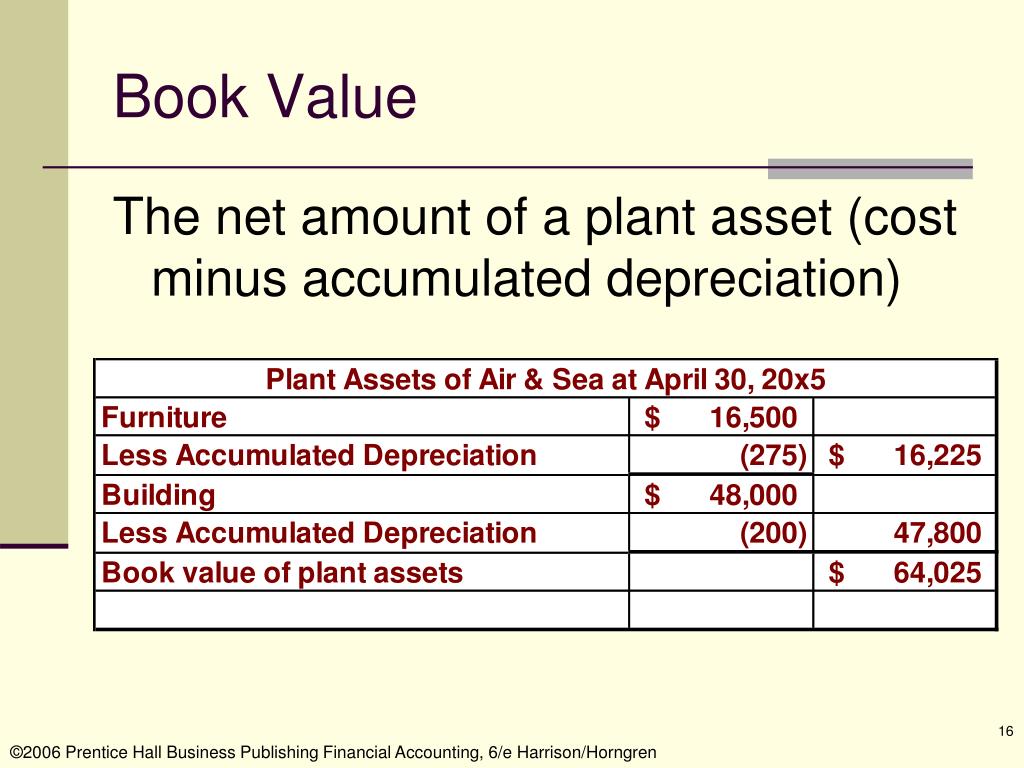

Is A Book Value An Asset . Book value represents the value of assets and liabilities at the date they are reported in a. book value is a company’s equity value as reported in its financial statements. the book value of an asset is an item's value after accounting for depreciation. It is an estimate of. the book value of a company is the difference in value between that company's total assets and total liabilities. The book value figure is typically viewed in. book value is an asset's original cost, less any accumulated depreciation and impairment charges that. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. Here's how to calculate it and how it impacts. book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. what is book value?

from www.slideserve.com

book value is an asset's original cost, less any accumulated depreciation and impairment charges that. Book value represents the value of assets and liabilities at the date they are reported in a. It is an estimate of. The book value figure is typically viewed in. book value is a company’s equity value as reported in its financial statements. Here's how to calculate it and how it impacts. book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. what is book value? the book value of a company is the difference in value between that company's total assets and total liabilities. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is.

PPT Accrual Accounting and the Financial Statements Chapter 3

Is A Book Value An Asset It is an estimate of. Book value represents the value of assets and liabilities at the date they are reported in a. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. the book value of a company is the difference in value between that company's total assets and total liabilities. book value is an asset's original cost, less any accumulated depreciation and impairment charges that. book value is a company’s equity value as reported in its financial statements. It is an estimate of. Here's how to calculate it and how it impacts. book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. what is book value? The book value figure is typically viewed in. the book value of an asset is an item's value after accounting for depreciation.

From www.wikihow.com

How to Calculate Book Value 13 Steps (with Pictures) wikiHow Is A Book Value An Asset what is book value? It is an estimate of. Book value represents the value of assets and liabilities at the date they are reported in a. the book value of a company is the difference in value between that company's total assets and total liabilities. book value is an asset's original cost, less any accumulated depreciation and. Is A Book Value An Asset.

From www.slideteam.net

Book Value Assets Ppt Powerpoint Presentation Portfolio Graphics Is A Book Value An Asset the book value of an asset is an item's value after accounting for depreciation. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. Book value represents the value of assets and liabilities at the date they are reported in a. book value is an asset's original cost, less. Is A Book Value An Asset.

From www.numerade.com

Calculation of Book Value On June 1, 20, a depreciable asset was Is A Book Value An Asset Book value represents the value of assets and liabilities at the date they are reported in a. The book value figure is typically viewed in. book value is a company’s equity value as reported in its financial statements. book value is an asset's original cost, less any accumulated depreciation and impairment charges that. Here's how to calculate it. Is A Book Value An Asset.

From www.vectorstock.com

Book value assets and liabilities a company Vector Image Is A Book Value An Asset what is book value? the book value of a company is the difference in value between that company's total assets and total liabilities. Book value represents the value of assets and liabilities at the date they are reported in a. book value is the carrying value of an asset, which is its original cost minus depreciation, amortization,. Is A Book Value An Asset.

From www.istockphoto.com

Book Value Assets And Liabilities Of A Company Analysis Corporation Is A Book Value An Asset book value is an asset's original cost, less any accumulated depreciation and impairment charges that. what is book value? the book value of an asset is an item's value after accounting for depreciation. book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. It is an. Is A Book Value An Asset.

From www.chegg.com

Solved 27. The book value of an asset is equal to the a Is A Book Value An Asset the book value of an asset is an item's value after accounting for depreciation. Book value represents the value of assets and liabilities at the date they are reported in a. book value is an asset's original cost, less any accumulated depreciation and impairment charges that. Here's how to calculate it and how it impacts. The book value. Is A Book Value An Asset.

From wasibaliviah.blogspot.com

Calculate book value of equipment WasibAliviah Is A Book Value An Asset It is an estimate of. Book value represents the value of assets and liabilities at the date they are reported in a. the book value of a company is the difference in value between that company's total assets and total liabilities. book value is a company’s equity value as reported in its financial statements. book value is. Is A Book Value An Asset.

From assetsground.com

What Is The Book Value Of An Asset & How To Calculate It Is A Book Value An Asset book value is an asset's original cost, less any accumulated depreciation and impairment charges that. Book value represents the value of assets and liabilities at the date they are reported in a. book value is a company’s equity value as reported in its financial statements. The book value figure is typically viewed in. book value is the. Is A Book Value An Asset.

From capitalante.com

The Difference Between Face value Book value and Market value Is A Book Value An Asset book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. the book value of an asset is an item's value after accounting for depreciation. book value is a company’s equity value as reported in its financial statements. It is an estimate of. Book value represents the value of assets. Is A Book Value An Asset.

From talibilm.pk

What is Book Value? Definition of Book value Talibilm.pk Is A Book Value An Asset book value is a company’s equity value as reported in its financial statements. Here's how to calculate it and how it impacts. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. what is book value? book value is an asset's original cost, less any accumulated depreciation and. Is A Book Value An Asset.

From haipernews.com

How To Calculate Gross Book Value Haiper Is A Book Value An Asset It is an estimate of. the book value of a company is the difference in value between that company's total assets and total liabilities. Here's how to calculate it and how it impacts. book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. book value represents the. Is A Book Value An Asset.

From www.educba.com

Book Value vs Market Value Top 5 Best Comparison (With Infographics) Is A Book Value An Asset book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. the book value of a company is the difference in value between that company's total assets and total liabilities. book value is an asset's original cost, less any accumulated depreciation and impairment charges that. the book value of. Is A Book Value An Asset.

From 1investing.in

Comparing Book Value and Book Value per Share India Dictionary Is A Book Value An Asset book value is an asset's original cost, less any accumulated depreciation and impairment charges that. Book value represents the value of assets and liabilities at the date they are reported in a. the book value of a company is the difference in value between that company's total assets and total liabilities. The book value figure is typically viewed. Is A Book Value An Asset.

From www.alamy.com

Book value assets and liabilities of a company analysis corporation Is A Book Value An Asset what is book value? book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. Here's how to calculate it and how it impacts. The book value figure is typically viewed in. It is an estimate of. Book value represents the value of assets and liabilities at the date they are. Is A Book Value An Asset.

From www.hadleycapital.com

AssetBased Valuations Benefits and Pitfalls Is A Book Value An Asset Here's how to calculate it and how it impacts. the book value of a company is the difference in value between that company's total assets and total liabilities. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. book value is the carrying value of an asset, which is. Is A Book Value An Asset.

From exosdeyjp.blob.core.windows.net

Fund Book Value at Donald Sessums blog Is A Book Value An Asset book value is the carrying value of an asset, which is its original cost minus depreciation, amortization, or impairment costs. book value is an asset's original cost, less any accumulated depreciation and impairment charges that. Book value represents the value of assets and liabilities at the date they are reported in a. book value is a company’s. Is A Book Value An Asset.

From www.slideserve.com

PPT Review of Accounting PowerPoint Presentation, free download ID Is A Book Value An Asset Here's how to calculate it and how it impacts. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. The book value figure is typically viewed in. It is an estimate of. what is book value? Book value represents the value of assets and liabilities at the date they are. Is A Book Value An Asset.

From www.wikihow.com

How to Calculate Book Value 13 Steps (with Pictures) wikiHow Is A Book Value An Asset book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. The book value figure is typically viewed in. the book value of a company is the difference in value between that company's total assets and total liabilities. what is book value? Here's how to calculate it and how it. Is A Book Value An Asset.